The Complete Receipt Maker Guide (Updated 2025)

Creating a receipt might seem straightforward - you jot down what someone bought, they pay, you hand over a piece of paper. But there's more nuance to receipts than most people realize. Whether you're a freelancer sending your first invoice, a small business owner looking professional, or someone building a system that will actually work at tax time, understanding receipt fundamentals changes everything.

This guide covers everything you need to know about making receipts: the legal requirements you can't ignore, the different receipt types that actually matter, the tax documentation strategies that save you hours come April, and the customization tactics that make your receipts work harder for your business.

Let's start with why receipts matter more than you think.

Why Receipts Matter More Than You Think

Most people see receipts as transactional paperwork - a formality to get through. The customer's handed their change, the receipt goes in their pocket, everyone moves on. But receipts are actually doing invisible work in the background.

For your customer: A receipt is proof of purchase. It protects them if something breaks, if they need to return it, if they need to expense it to their business, or if they need proof of the transaction for warranty claims. A receipt without proper information is nearly useless for these purposes.

For you: A receipt is legal documentation of your income. The IRS doesn't ask for receipts you've collected from other businesses as often as people think - but the receipts you issue are your proof that you actually made that money. Come tax season, "I remember I sold stuff" isn't documentation. A detailed receipt is.

For your business professionalism: This one's subtle but important. A customer who gets a thoughtfully made receipt, numbered sequentially, with your business information clearly displayed, thinks "this is a real business." A scrawled note says "this person doesn't have it together."

The receipts you issue shape how people perceive your business, whether they're customers, vendors looking to work with you, or accountants trying to figure out if you have legitimate income.

The Different Types of Receipts You'll Encounter

Not all receipts are the same. Understanding the distinctions helps you create the right document for each situation.

Service Receipts

When someone pays you for work - consulting, plumbing, lawn care, personal training - you're issuing a service receipt. This needs to describe what was done and for how long or to what extent.

"Consulting" is vague. "3 hours of WordPress website troubleshooting" is specific. When a customer questions a charge later, specific descriptions protect you. Service receipts don't need itemized lists like retail does, but they do need clarity about what actually happened.

Retail Receipts

Someone buys physical products. You list each item, quantity, and price. If they're buying five different things, the customer needs to see the breakdown. Retail receipts are the most common type, and they're what most receipt templates assume you're creating.

Digital/Email Receipts

The customer never sees a physical piece of paper - you send a PDF or email with the transaction details. More common now than physical receipts. Same information requirements, but no paper, no printer needed. For tax purposes, these work just fine as long as you keep digital copies.

Return/Exchange Receipts

When a customer returns something, this receipt documents what was returned, the refund amount, and why. Important for tracking inventory and cash flow accurately. If you issue return receipts, your accounting gets cleaner because you're explicitly showing money going back out.

Cash-Out/Drawer Receipts

Some businesses print a receipt when they physically cash out a drawer at the end of the day. This documents the total collected and who handled it. Important for businesses that process hundreds of transactions where reconciliation matters.

Composite/Multi-Transaction Receipts

A customer makes multiple purchases over time and gets one receipt showing the total at month-end. Common in B2B scenarios or subscription services. These need clear dating for when transactions occurred.

Most people creating receipts will work with service or retail receipts. The others become relevant as your business gets more complex.

Legal Requirements: What You Actually Have to Include

This is where receipts get serious. The requirements differ slightly by location, but there are universal standards.

What almost everywhere requires:

Your business name and location. Not optional. The receipt proves the transaction happened - the person reading it needs to know who they transacted with and where. If someone disputes the charge with their credit card company, they'll look at the receipt to confirm the merchant. Missing this? Disputes get messy.

Date of transaction. Yes, this actually matters legally. Receipts without dates are basically useless for tax purposes. The IRS wants to know when transactions occurred for matching with your business books.

Items purchased or services provided. Description matters. "Item" is insufficient. "Gray T-shirt, size L" or "Website design consultation, 4 hours" is what you need.

Amount paid and payment method. How much left their pocket? Cash, card, check? This documentation matters for reconciliation. If you keep detailed payment records, you can match them to your bank deposits.

What many locations require additionally:

Sales tax displayed separately if applicable. Your state probably has rules about how sales tax shows up on receipts. Usually it needs to be broken out: subtotal, tax, total. Not lumped into the total.

Your tax ID or business registration number. Some states require this. Check your local regulations - it varies significantly.

Return policy or notice if one exists. Some jurisdictions require businesses to clearly communicate return policies on every receipt.

What varies by location:

Some places require specific language about consumer rights. Others have rules about receipt paper (readable for 7 years). Some require QR codes or specific identifiers.

The honest truth: Most small businesses can't be expected to know every local regulation. What you should do: Check your state's tax authority website and your city's business regulations. It takes 20 minutes and saves you from accidentally violating something later. The information is public.

If you're using an online receipt maker like ours, the templates are built to meet most standard requirements in most places. But don't just assume - verify for your specific location.

How to Create Different Receipt Types

Let's get practical. Here's how to actually build receipts that work.

Creating a Professional Service Receipt

A service receipt is simpler than it looks. You're documenting what you did and what they paid. Here's what it needs:

Start with your information at the top. Business name, your address (or just city/state if you work mobile), phone number, email. If you have a website, include it.

Then the essential transaction info:

- Receipt number (just number sequentially - makes tracking easier)

- Date of service (not today's date if you're billing after the work)

- Customer name

- What you did (be specific)

- Rate or total amount

- How they paid

End with a thank you. Small touch, but it matters.

Here's what this looks like in practice:

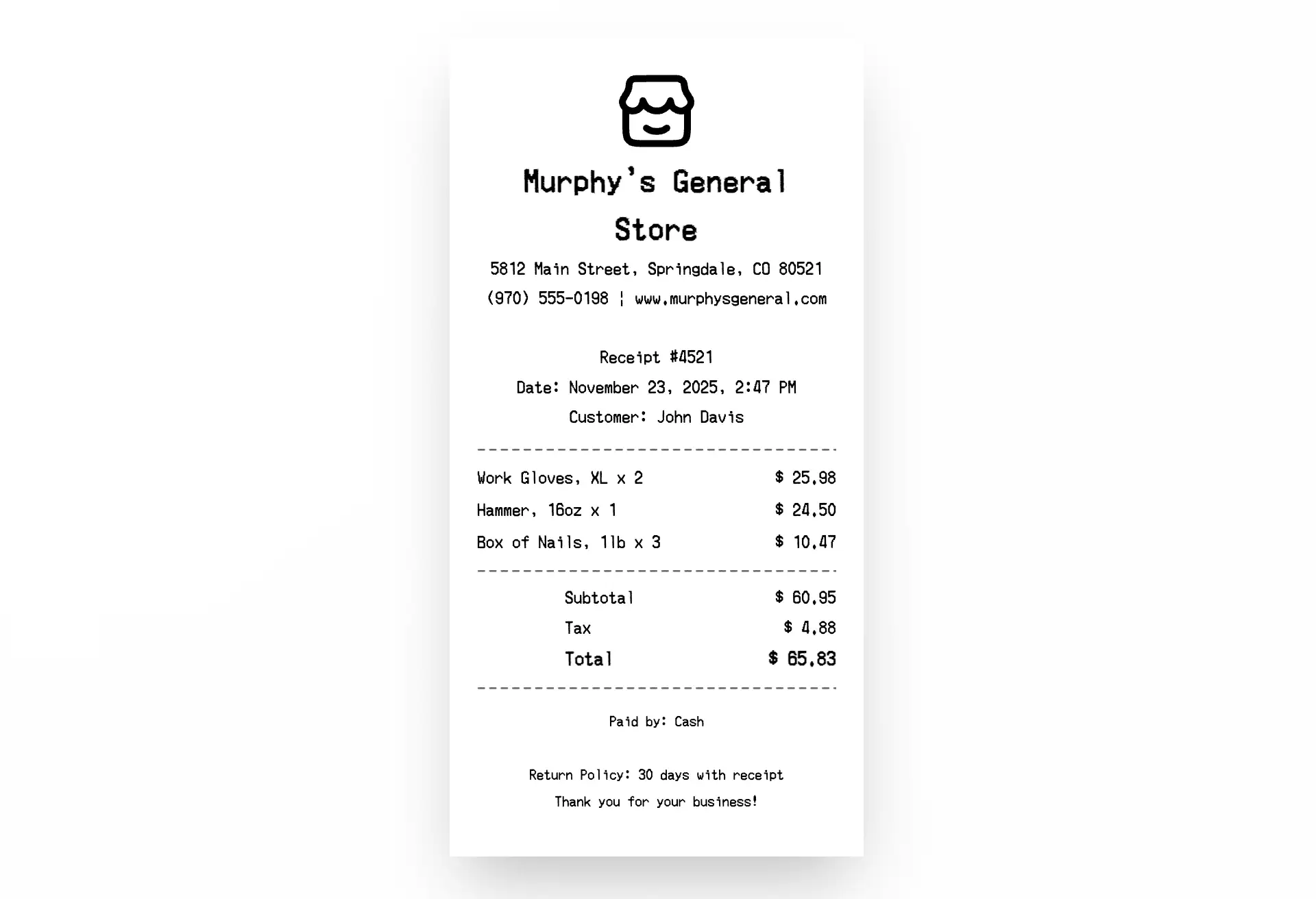

That's a complete, professional service receipt. It has everything needed. If Sarah ever needs to prove she paid for photos, this receipt does that. If you need to prove you earned this income, this receipt does that.

Creating a Detailed Retail Receipt

Retail's slightly more complex because you're listing multiple items. Same header information, but now you need clarity on what each thing costs.

Notice the structure - it's easy to scan. Customer sees exactly what they bought and what it cost. You have documentation of your sales. Tax is shown separately. Everyone's protected.

Creating a Digital Email Receipt

Digital receipts follow the same rules, just delivered electronically. Same information, same requirements. The advantage? The customer can't lose it, it goes straight to their email, they can search for it later.

Most online receipt makers and accounting software will generate these automatically. You enter the transaction, they create a nice PDF, you send it via email. No printer needed, no paper waste, customers prefer it.

Mastering Tax Documentation Through Better Receipts

This is where receipts become genuinely strategic. A thoughtfully structured receipt saves you massive headaches at tax time.

Why Receipt Details Matter for Taxes

When you sit down with your accountant or tax software in January, you'll have a folder of receipts from the entire year. Your accountant will categorize them - which are business deductions, which are personal, which are taxable income.

A receipt that just says "supplies - $150" makes their job harder. They have to guess. A receipt that says "Office paper, 5 reams, $12.99 per ream" is clear. Professional equipment? Office supplies? Suddenly categorization is obvious.

For the receipts you issue (income), the same applies. A vague service receipt makes it hard to prove what you actually provided. A detailed one is ironclad.

Documentation Categories That Matter

Income receipts - These prove what you earned. Include service descriptions, dates, amounts. The more specific, the better they hold up to scrutiny.

Expense receipts - You're collecting these from other businesses. Save them all. But when you're creating receipts, include enough detail that if you're later audited, the other person's receipt clearly shows what they bought and how much they paid. It all matches.

Sales tax documentation - If you're required to collect sales tax, receipts need to show it separately. This documentation proves you collected the tax correctly. If you're ever audited on sales tax, the IRS will ask for receipts.

Employee reimbursement - If you reimburse employees, receipts prove what was actually spent. Same requirements apply.

The 7-Year Rule

The IRS wants you keeping records for 7 years. Seven. Not 3, not 5, not 1. That's the safe number. Your receipts need to:

- Be legible - thermal paper fades, so PDF copies are better

- Be organized - by date or category so you can find them

- Include all necessary information

- Be preserved - backed up, not just sitting in a shoebox

This is why digital receipts and receipt-keeping systems matter. A stack of faded thermal receipts in a box is technically documentation but practically useless in an audit. Well-maintained digital records are gold.

Customization Strategies That Actually Work

Generic receipts work. But receipts customized to your business work better.

Adding Your Branding

Your receipt is a marketing touchpoint. A customer gets handed a receipt and sees it has your logo, your colors, your personality. It reinforces that you're a real business.

This doesn't mean making receipts look like they're from a nightclub. It means:

- Your logo in the header (even a simple text-based logo works)

- Your brand colors in subtle ways (maybe a colored border, or receipts on colored paper)

- Consistent fonts - pick two that work, use them everywhere

- White space - don't cram everything together

- Your website or social media handles at the bottom

The goal is for someone to see a receipt you issued and immediately know it came from you. That's good branding.

Building in Customer Retention Elements

Your receipt is one of the last touchpoints before the customer leaves. Use it strategically.

Add a simple call-to-action - "Review us on Google," "Join our mailing list at [website]," "Follow us on Instagram." Don't make it aggressive. Just give them an easy next step if they're interested.

Include your return policy. This protects you, but it also makes customers feel confident. "30-day returns with receipt" is comforting. If a customer isn't sure about an item, knowing they can return it changes their buying decision.

Add a thank you message. "Thanks for your business!" or "We appreciate you!" is tiny but genuinely appreciated by customers. People notice when businesses say thank you.

Segmenting Receipt Types for Different Customers

If you serve different types of customers, create slightly different receipt formats for each. B2B customers might want different information than retail customers.

A corporate client doing expense reporting needs invoice-style receipts with dates, amounts, descriptions, tax info all clearly laid out. A regular retail customer just needs proof of purchase.

You can create multiple templates and choose which to use based on who's buying.

Adding QR Codes or Digital Elements

QR codes on receipts are becoming more common. Link to:

- Your review page

- A feedback survey

- Your website

- Social media

This creates a path from physical receipt to digital engagement. A customer pulls out their phone, scans the code, leaves you a review. That's valuable.

Choosing the Right Receipt Solution for Your Business

Different businesses need different systems. Here's how to think about it.

Just starting out, occasional sales? Use a free online receipt maker. No setup, no monthly fees, professional results. You fill in the form, download the PDF, send it or print it. Done.

Regular sales but still small? Create a template in Google Docs or use an online tool that lets you save templates. Faster than starting from scratch each time.

Growing business with employees? Consider accounting software like Wave (free) or QuickBooks. You get receipts, invoicing, bookkeeping, all connected. Your employees can create receipts if needed. Everything's backed up automatically.

Retail store or high transaction volume? POS system with built-in receipt printer. Square, Shopify POS, Toast, or similar. The software handles inventory, payments, receipts, everything simultaneously.

Service business that needs professional invoicing? FreshBooks or similar. Receipt creation plus project tracking, time logging, invoicing. Everything integrated.

The best system is the one that matches your current complexity and doesn't require learning unnecessary features.

A Practical Look at Creating Receipts in Under 60 Seconds

If you're going to actually use your receipt system, it needs to be fast. Here's what 60 seconds of receipt creation looks like with an optimized process:

This is exactly how fast the process should be. You enter transaction details, it generates the receipt, you send it or print it. If receipt creation takes longer than 2-3 minutes per receipt, your system is too complicated.

The goal is: receipt creation should never be a bottleneck in your business. It should take seconds.

Common Receipt Mistakes and How to Avoid Them

We've helped thousands of people create receipts. Here are the patterns we see break down:

Missing dates. You'd be surprised how often receipts lack dates. The date is critical - it ties the transaction to your calendar, makes tax time easier, enables refund policy windows. Always include it.

Vague item descriptions. "Supplies purchased" tells nobody anything. "5 reams of 20lb copy paper, white" is clear. Future you (or an accountant reviewing your books) will be grateful.

No sequential numbering. Your first receipt is #1, your second is #2. This makes tracking sales easier and shows organization. It's also helpful if someone questions whether a receipt is legitimate - a numbered system is harder to fake.

Forgetting to keep copies. You hand over a receipt and forget to save one for yourself. Months later you can't prove the sale happened. Save everything - digitally if possible, so they're backed up.

Wrong tax calculation. You're supposed to charge X% tax but you calculated wrong. Or you forgot to include tax when you should have. Check your local requirements, verify your math, move on.

Illegible handwriting. If you're writing receipts by hand, take a second and write clearly. Receipts with chicken-scratch writing make your business look unprofessional and don't hold up well if anyone questions them.

No backup system. You're creating receipts but not backing them up anywhere. Your computer crashes, your phone gets lost, and suddenly you have no documentation of your sales. Cloud backup or printed copies - pick something.

Legal Considerations by Business Type

Different business structures have different receipt requirements.

Sole proprietor (you): Pretty flexible. Create receipts that include your business name, date, items, amount, payment method. Keep copies for your records.

LLC or S-corp: Same as sole proprietor, but consider adding your business registration number or EIN (employer identification number) for legitimacy, especially on B2B receipts.

Restaurant or retail with employees: More regulation. You might need to register your receipts with your state's tax authority. The receipts themselves need to show certain information. Check your state's requirements specifically - this varies significantly.

Service business with tax obligations: Focus on clear service descriptions and dates. You're going to be explaining what you did when you file taxes, so receipts that clearly document that are essential.

Online business (selling digital products): Different rules about where you charge tax. You're probably charging tax in the buyer's location, not your location. Receipts need to reflect this correctly.

Nonprofit: You might issue donation receipts instead of traditional receipts. Different format, different requirements. Check IRS guidance for nonprofit receipt requirements.

The common thread: check your specific location's regulations. It takes an hour to look up, and it prevents months of problems later.

Integrating Receipts Into Your Overall Financial System

A receipt isn't an island. It's part of a larger system that tracks your income, documents your expenses, and keeps you sane at tax time.

Connect your receipts to your accounting: Whether you're using spreadsheets, Wave, or QuickBooks, receipts feed into your bookkeeping. Every receipt you issue becomes a line in your income record.

Create a filing system: Receipts in a shoebox don't work. Create a simple system - folders by date, by customer, by category, whatever you'll actually maintain. Even just a "2025 Receipts" folder on your computer is better than random.

Reconcile regularly: Once a month, glance at your receipts and make sure they match what you think you made. Monthly reconciliation is way easier than annual.

Back up everything: Every quarter, export your receipt records somewhere else. Email them to yourself, save to cloud storage, print them, something. Redundancy is your friend.

Create templates for your common receipt types: Don't start from scratch every time. Template for service receipts, template for retail, template for whatever you frequently create. Fill in the details, done.

The receipt is step one. The system around it is what actually works.

Making Receipt Creation Part of Your Business Routine

The best receipt system is the one you'll actually use. Most receipt problems come from people not creating them consistently, not from lacking the ability to create them.

Make it immediate: Create the receipt when the transaction happens, not later. Later becomes "eventually" becomes "wait, how much did that client pay me three months ago?"

Make it automatic if possible: If you use payment processing (Square, PayPal, Stripe), these generate receipts automatically. You're not thinking about it, it just happens.

Make it visible: If you're manually creating receipts, have your template open and ready. Don't hunt for it every time - create friction-free access.

Make it a trigger: Right after you get paid or make a sale, create the receipt. Make it part of the immediate transaction, not an afterthought.

Some people set a calendar reminder at the end of each week - "Create any missing receipts." Others do it daily. Whatever rhythm you'll actually maintain is the right rhythm.

Better Receipts, Better Business

This guide covered a lot, but the core is simple: receipts are documentation of your business activity. They protect you legally, help you track income accurately, shape how customers perceive you, and make tax time dramatically easier.

A receipt is 2 minutes of thought and action that prevents months of headaches. The time investment pays for itself immediately.

Whether you're starting your first business or optimizing your hundredth transaction, approaching receipts strategically - not just as a checkbox - changes how your business runs.

Start with this: Create a template for your most common receipt type. Save it somewhere easy to access. Next time you need a receipt, use it. Save a copy for yourself. Repeat.

That's it. You're now running a business that documents itself properly. Your future accountant will thank you, your customers will notice the professionalism, and you'll sleep better knowing you're organized.

For more detailed receipt templates and examples, explore our professional receipt templates. If you need to create receipts regularly, check out our guide on how to make receipts for small businesses for different methods and tools that scale with your business.

Now go create your first receipt. Don't overthink it. You've got this.